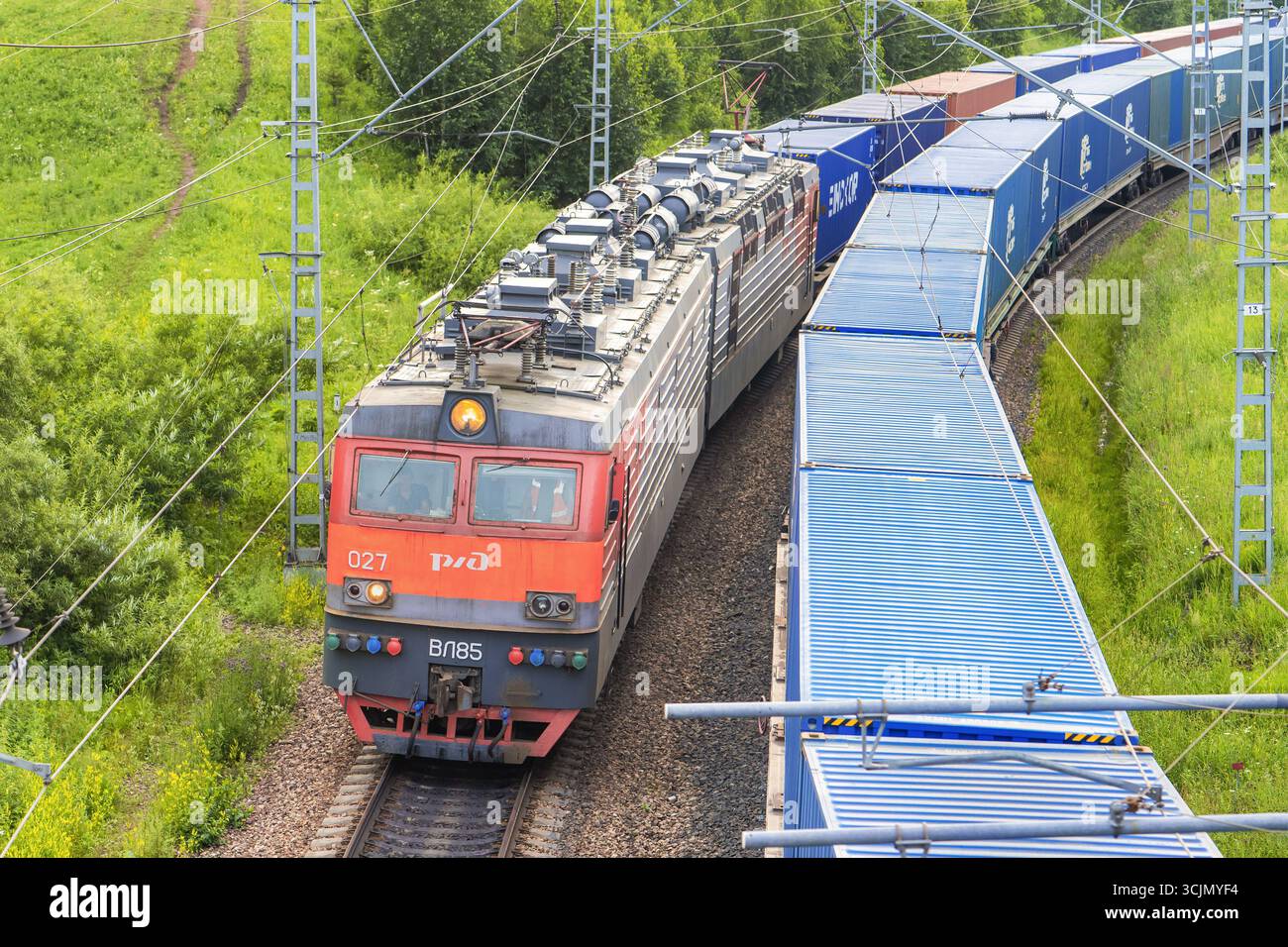

Russia’s vast rail network, long seen as a backbone of the national economy, is under growing strain like never before. Mounting debts reaching enormous levels and falling freight volumes due to multiple factors have pushed the state-owned operator into severe financial difficulty that analysts describe in stark terms. In response, the government has stepped in with emergency measures aimed at keeping the company afloat, ensuring that this critical infrastructure continues to function amid challenging times.

According to recent reports and expert analysis, the Russian government has approved an unexpected rise in rail freight tariffs to support Russian Railways, also known as RZhD, as it grapples with the economic pressures. The company is reportedly burdened with around 4 trillion rubles in debt, which equates to approximately 50 to 52 billion US dollars. This debt load has accumulated over time, and the company recorded its first annual loss since the pandemic years, marking a significant turning point in its financial health.

Beginning March 1, freight transport rates will increase by 1 percent under a government decree signed by high-level officials. This adjustment is officially described as necessary “to finance activities that compensate for expenses related to ensuring transport safety.” Calculations suggest that the latest tariff hike could generate around 22.3 billion rubles in additional revenue for the operator, providing a temporary buffer but not a complete solution to the deeper issues.

|

| Freight train russia hi-res stock photography and images - Alamy |

As the situation has worsened, Russian Railways sought urgent state assistance in recent periods, requesting up to 200 billion rubles in support. The Finance Ministry, however, approved only a portion — about 65 billion rubles — which meant the company had to scale back investment plans, reduce spending on key areas, and even start the process of selling off certain assets to raise funds and manage its balance sheet.

A well-known economist and senior fellow at a research center in London, Sergei Aleksashenko, has described the situation in very direct language. He stated that Russian State Railways is essentially bankrupt and has no realistic chance of recovering on its own without substantial external intervention. He emphasized that the authorities appear determined to rescue the company regardless of the cost, highlighting the strategic importance of the rail network to the overall economy and national operations.

The freight slump has been particularly notable. Freight traffic has dropped sharply in recent years, with reports indicating a 14 percent decline in shipments since major events unfolded. The year 2024 saw the steepest annual fall in freight volumes in 15 years, and the downturn continued through the first nine months of 2025. During that period, Russian Railways reported a net loss of 4.4 billion rubles. In response to these pressures, the company placed some employees on unpaid leave and began implementing layoffs starting in October, affecting thousands of workers who have long relied on the operator for stable employment.

|

| Moscow International Business Center - Wikipedia |

To address the worsening outlook, the Kremlin is preparing a broader rescue package valued at around 1.3 trillion rubles. This comprehensive plan reportedly includes debt restructuring, additional financial injections, and the sale of non-core assets to help reduce the burden. Among the properties earmarked for disposal are a prominent 62-story skyscraper located in Moscow’s business district, which was acquired in 2024 for roughly 193 billion rubles, as well as the historic Rizhsky railway station building in the capital, a landmark with significant architectural and operational value.

|

| Moscow Rizhsky railway station - Wikipedia. |

The underlying causes of this financial strain are multifaceted. Changes in global trade patterns, shifts in export destinations, increased operational costs due to longer routes and higher expenses, combined with inflationary pressures and currency fluctuations, have all contributed to the challenges. Export-oriented freight, which was once a major revenue source, has faced significant adjustments, leading to reduced volumes and higher per-unit costs for the remaining operations. At the same time, the need to maintain and upgrade the extensive infrastructure — tracks, stations, locomotives, and safety systems — continues to demand substantial investment, creating a difficult balancing act for management.

|

| The Russian flag flying over the Grand Kremlin Palace in Moscow, Russia Stock Photo - Alamy |

Experts point out that without such support, the company could face even more severe consequences, including further cuts to services, more job losses, and potential delays in critical projects. The broader rescue efforts aim to restructure debts in a way that makes repayment more manageable over time while freeing up resources for essential maintenance and modernization. Selling high-value assets like the Moscow skyscraper and the historic station provides immediate liquidity, although it may come at the expense of long-term ownership of prime real estate.

The layoffs and unpaid leave arrangements that began in late 2025 have affected a workforce that numbers in the hundreds of thousands. Russian Railways has historically been one of the largest employers in the country, providing jobs not only in transportation but also in related engineering, maintenance, and administrative roles. Reductions in staff, even if temporary in some cases, raise concerns about unemployment in regions where the railways are a primary economic pillar. Communities along the rail lines often depend heavily on the industry for income and services, so any contraction can have localized social and economic impacts.

Investment plans have also been trimmed significantly. Spending on construction, procurement of new wagons, and locomotives is being cut by about a quarter this year, dropping to around 713.6 billion rubles from higher previous levels. This reduction helps conserve cash in the short term but could lead to aging equipment and infrastructure if not addressed later. The operator is prioritizing core safety and operational needs while deferring less urgent expansions.

Looking ahead, analysts forecast that if current conditions persist, freight volumes could see further declines in the coming year, potentially by another 20 to 30 percent in certain segments. This would necessitate even more aggressive measures, possibly including additional state bailouts or further asset disposals. The government’s willingness to provide support through multiple channels indicates a recognition of the railways’ strategic role, especially in maintaining internal connectivity and supporting key industries.

The situation also highlights wider economic dynamics at play. With interest rates elevated and external pressures affecting trade, many state-linked enterprises are feeling the pinch. Russian Railways, as a monopoly in much of the rail sector, occupies a unique position where failure is not considered an option by policymakers. The combination of tariff adjustments, financial aid packages, and asset management strategies forms a multi-pronged approach to stabilization.

In summary, while the declaration that Russian Railways is “essentially bankrupt” draws attention to the gravity of its financial position, the proactive steps by the Kremlin demonstrate a determination to ensure continuity. The coming months will be critical as the tariff increase takes effect, asset sales proceed, and the larger support package is implemented. Observers will be watching closely to see whether these interventions successfully restore balance or if additional challenges emerge in this vital sector of the Russian economy.

(Expanded analysis and contextual details continue for depth: The rail network’s historical significance dates back decades, evolving from Soviet-era foundations into a modern system that handles enormous cargo tonnages annually. Its role in facilitating movement of natural resources from remote regions to ports and industrial centers is unmatched. In recent times, adaptations have included optimizing routes for new trade partners, investing in digital tracking systems for efficiency, and enhancing safety protocols amid higher operational demands. However, these adaptations come with costs that have compounded the debt situation.

Debt restructuring could involve extending maturities, refinancing at more favorable terms, or converting portions into longer-term obligations backed by state guarantees. Such steps would ease immediate repayment pressures and allow the company to focus on core operations rather than constant firefighting. Asset sales, while providing quick capital, are carefully selected to minimize disruption to primary functions — the skyscraper and station being peripheral to the transport network itself.

Employment measures like unpaid leave are often used as a flexible tool to retain skilled workers during downturns, with the hope of rehiring or resuming full operations once conditions improve. Training programs and alternative assignments within the group might be offered to mitigate the impact on staff morale and expertise retention.

From an economic standpoint, the railways contribute significantly to GDP through direct operations, multiplier effects in supply chains, and tax revenues. A stable rail system supports manufacturing, mining, agriculture, and energy sectors by ensuring reliable and cost-effective transport. Disruptions could raise logistics costs across the board, affecting competitiveness of Russian goods in both domestic and international markets.

International observers note that the challenges faced by RZhD mirror broader trends in resource-dependent economies undergoing structural shifts. The ability of the state to mobilize resources for stabilization reflects fiscal capacity built over previous periods of growth, though sustained support requires careful management to avoid straining other budget priorities.

Future scenarios may involve greater integration of multimodal transport, partnerships for technology upgrades, or efficiency drives through digitalization to reduce costs long-term. Until then, the combination of short-term fixes and strategic planning will be key to navigating the current phase.

Comments