Analysts and White House-backed reports predict an average tax refund boost of around $1,000 or more in 2026, driven by retroactive provisions in the One Big Beautiful Bill Act (OBBBA) and unchanged 2025 withholding tables.

White House: Average Tax Refund to Rise $1,000 in 2026

The White House describes this as potentially the largest refund season ever, with averages rising $1,000+ thanks to retroactive tax relief like no tax on tips/overtime, senior deductions, and more.

How Much is My 2026 Tax Refund? White House Estimates

Individual refunds vary by income, deductions, and eligibility for new credits—but White House estimates suggest many could see $1,000 more, pushing averages toward $4,000+ for qualifying filers.

Bigger Tax Refunds 2026: Average Payout to Hit $1,000

Projections from sources like the Tax Foundation indicate averages could climb $300–$1,000+ higher than recent years (~$3,167 in 2025 data), fueled by over-withholding and expanded relief.

IRS Tax Refund News: Why Your Check Could Be Higher

Reasons include retroactive OBBBA benefits (tip/overtime exemptions, senior/car loan deductions), no mid-2025 withholding adjustments, and boosted credits—leading to bigger refunds for many.

$1,000 Tax Refund Boost: 2026 Filing Season Updates

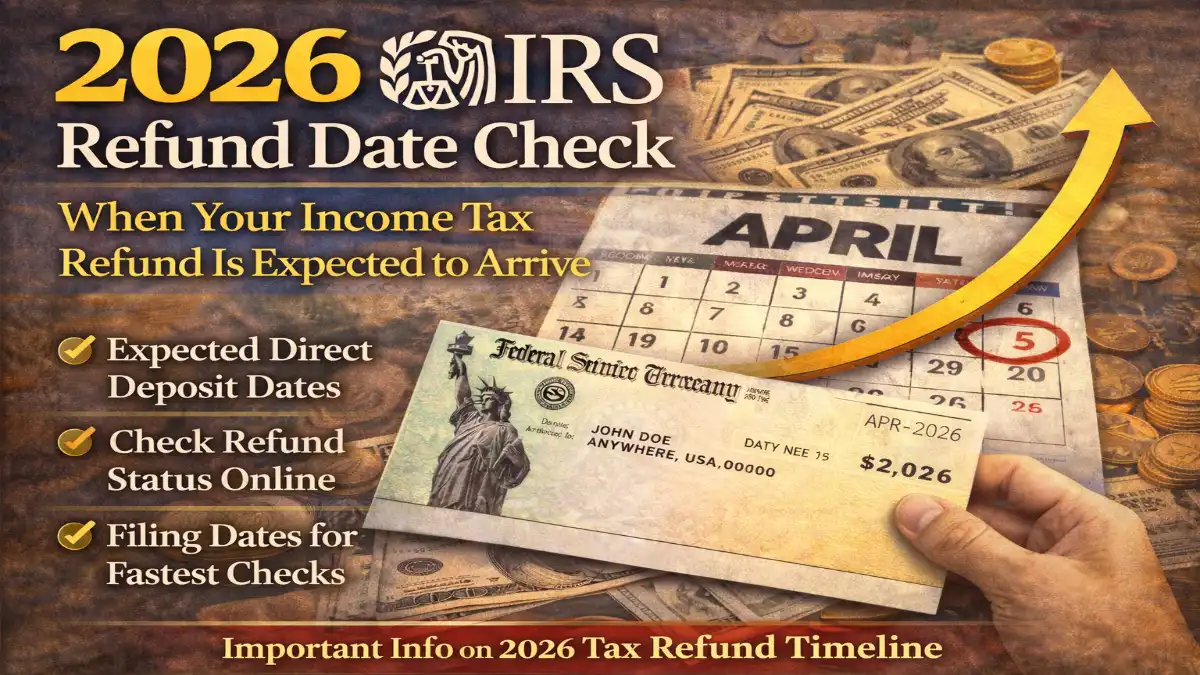

The boost ties to ~$100–$150B in extra refunds overall, per Treasury and independent analyses—file early via e-file for faster direct deposits (often within 21 days).

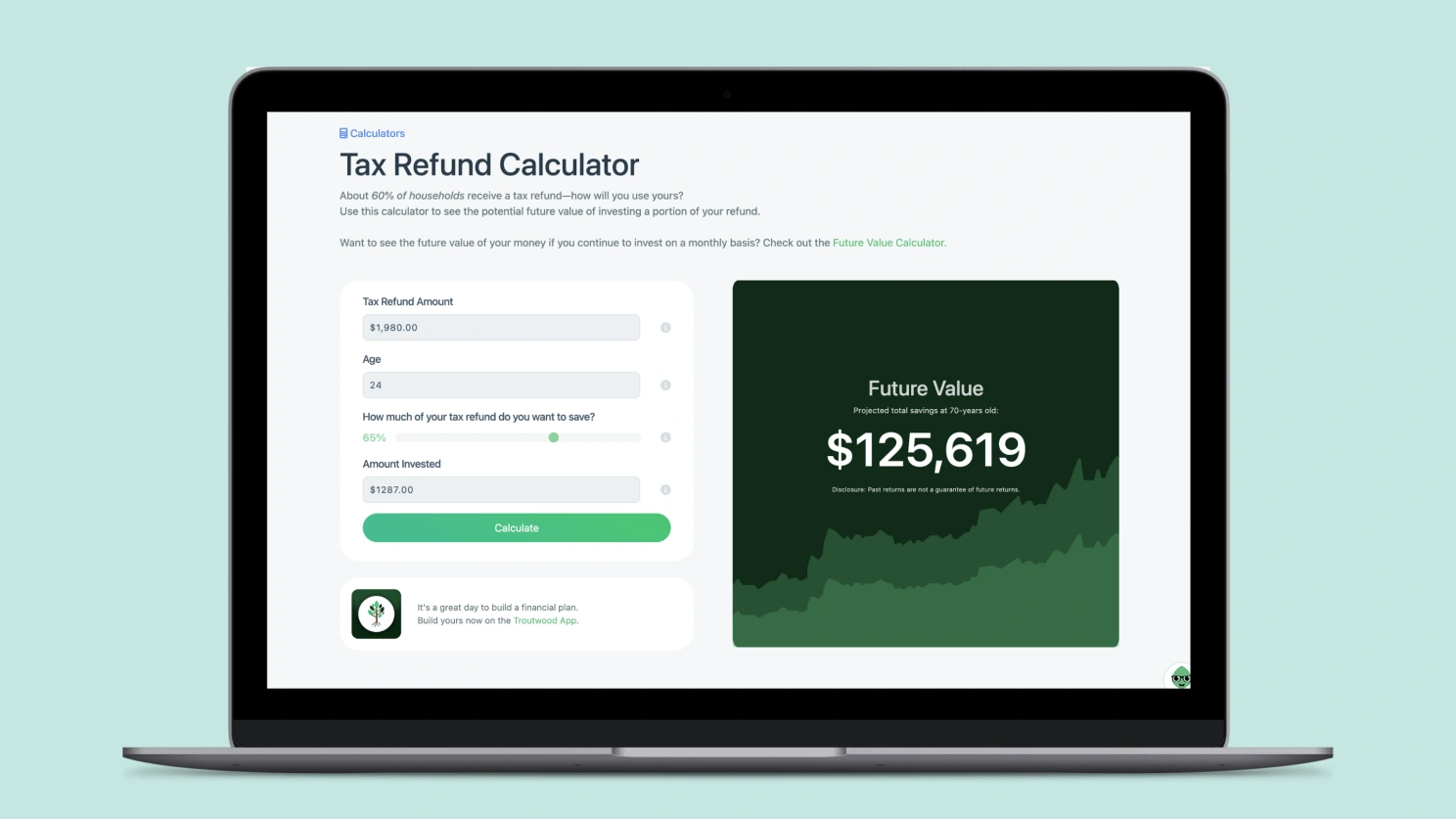

Calculate Your 2026 Tax Refund: New White House Data

Use IRS tools, free estimators, or third-party calculators to input your details and factor in OBBBA perks—many are projected to gain $1,000+.

Tax Season 2026: Why Refunds Are $1,000 Higher Now

Policy timing created excess withholding in 2025, converting cuts into larger refunds this year (vs. more take-home pay in future years).

Average 2026 Tax Refund Amount: White House Report

Expect averages potentially reaching $3,800–$4,000+, with the $1,000 increase highlighted across reports—higher for families and seniors qualifying for targeted provisions.

Comments

Post a Comment