The AI stock slump in 2026 has gripped markets, with software and tech stocks facing sharp sell-offs driven by fears of generative AI disruption. As of early February 2026, Anthropic's advancements in productivity tools, including legal automation, have intensified concerns, leading to widespread declines and erasing billions in value for software billionaires.

AI Stock Slump 2026

In February 2026, U.S. software stocks have extended a steep decline, with the S&P North American software index down significantly amid AI disruption fears. A major trigger was Anthropic's release of Claude-based tools for legal, sales, and data tasks, sparking "get me out" selling in shares of firms like Thomson Reuters, Intuit, ServiceNow, Adobe, and Salesforce. The sector has seen its worst monthly drops in years, with broader tech weakness rippling through Nasdaq and S&P 500.

Tech Stock Market Crash and $62 Billion Loss Tech

Software billionaires have collectively lost at least $62 billion in early 2026 due to the AI-fueled rout, per Bloomberg reports. This includes sharp drops in valuations for founders in advertising and enterprise software. While not a full market crash, tech-heavy indices have tumbled, with Nasdaq facing pressure from rotation out of AI names into defensive sectors.

AI Bubble Burst Concerns

Analysts debate an AI bubble burst in 2026, with parallels to past tech corrections. Surveys show over half of economists expecting U.S. AI stocks to decline, potentially with global repercussions. Massive capex continues, but slower ROI and valuation resets fuel volatility.

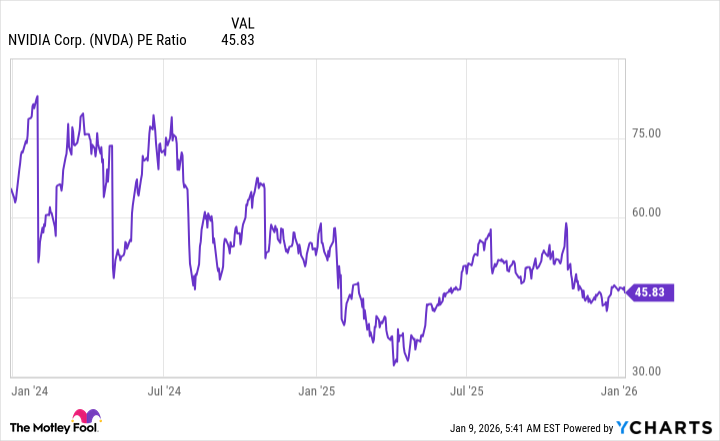

Nvidia Stock Drop and Jensen Huang Wealth

Nvidia (NVDA) shares have declined notably in early February 2026, trading around $175–$180 after recent sessions (e.g., closing at $180.34 on Feb 3, down further intraday). Despite this, CEO Jensen Huang's net worth holds strong at approximately $166 billion (Forbes, early 2026), ranking him among the world's top billionaires, supported by Nvidia's AI dominance.

)

Software Billionaires Net Worth and Larry Ellison Loss

Tech fortunes fluctuate amid the slump. Oracle's Larry Ellison has seen his net worth drop to around $211 billion (down $34 billion recently due to Oracle's 17% stock slide), though he remains in the top ranks.

Anthropic Stock News, Claude AI Valuation, Dario Amodei, and Anthropic Amazon Partnership

Private AI leader Anthropic, under CEO Dario Amodei, is pursuing a $20B+ funding round at a staggering $350 billion pre-money valuation, including an employee tender offer. This reflects strong demand for Claude AI models. Partnerships with Amazon (and Microsoft) bolster growth, with no major new disruptions reported.

Generative AI ROI, AI Monetization 2026, and Enterprise AI Spending

Enterprise AI spending surges, with hyperscalers eyeing $500B+ in 2026 capex, but ROI scrutiny grows. Monetization strengthens in productivity and coding, though conversion from investments remains gradual.

SaaS Valuation 2026, Cloud Computing Slowdown, and AI Sector Volatility

SaaS and cloud valuations reset amid disruption fears, with AI sector volatility high. Some slowdown signs appear in cloud growth as spending faces questions.

AI Stocks to Watch and Future of Tech Stocks

Watch resilient AI infrastructure plays like Nvidia for potential rebounds, alongside differentiated enterprise AI adopters. The future of tech stocks depends on proving sustainable ROI amid 2026's volatility—winners will emerge from disruption, while laggards face pressure.

This slump highlights AI investment risks and the AI hype cycle shift, but foundational demand suggests recovery potential beyond current corrections.

Comments

Post a Comment