California Tax Filing 2026: What's New for Residents – Complete Guide to Refunds, Credits, Deadlines & Changes

The 2026 tax filing season (for 2025 income) is in full swing for California residents. The Franchise Tax Board (FTB) officially launched the season on January 7, 2026, with e-filing available from January 26, 2026 (aligned with IRS). Major federal changes from the One Big Beautiful Bill Act (signed July 2025) impact California filers through partial conformity, including a quadrupled SALT deduction cap, new deductions for overtime, tips, and seniors, and permanent TCJA provisions. California maintains its progressive state income tax rates (1% to 12.3%, plus 1% mental health surcharge over $1M), generous CalEITC, and state-specific rules.

This detailed EEAT guide draws from official FTB sources, IRS updates, and reliable analyses to cover deadlines, new rules, refund tracking, CalEITC, SALT tips, and more. Always verify with ftb.ca.gov or a tax professional, as rules can evolve.

California Tax Deadlines 2026: When to File & Pay

The key deadline for filing your 2025 California resident income tax return (Form 540) and paying any owed taxes is April 15, 2026. California provides an automatic extension to file until October 15, 2026—no form or request needed—but any balance due must be paid by April 15 to avoid penalties (late-payment penalty up to 5% per month) and interest.

- Filing season start / e-file opens: January 26, 2026 (federal and state alignment).

- Timely e-filed returns deadline: April 15, 2026.

- Extension filing deadline: October 15, 2026.

- Estimated tax payments (Form 540-ES): Quarterly due dates – 1st: April 15, 2026; 2nd: June 15, 2026; 3rd: September 15, 2026; 4th: January 15, 2027.

- USPS postmark note: Recent USPS changes (effective Dec 2025) mean machine postmarks may reflect processing date (not drop-off), so e-file or get manual postmark at counter to avoid issues.

- Disaster relief: Special extensions or loss deductions may apply for declared disasters.

Use FTB Web Pay (free, select "extension") or other methods. e-filing is fastest and recommended.

SALT Cap Increase 2026: California Tax Filing Tips

The federal State and Local Tax (SALT) deduction cap rose from $10,000 (TCJA) to $40,000 for 2025 (filed 2026), per the One Big Beautiful Bill Act—retroactive to January 1, 2025. It increases 1% annually through 2029 ($40,400 in 2026), phases out above $500,000 MAGI ($505,000 in 2026), and reverts to $10,000 after 2029.

This benefits high-tax California residents (high property taxes + state income taxes). Tips:

- Itemize if SALT + mortgage interest, charity, medical (>7.5% AGI) exceed standard deduction (~$16,100 single/$32,200 joint federal for 2026; CA standard similar but adjusted).

- Coastal/high-property-tax areas see biggest gains—bundle deductions.

- Consider PTET (Passthrough Entity Tax) workarounds for businesses if SALT-limited.

- High earners: Phaseout starts at $500K—plan accordingly.

California conforms partially; consult for state adjustments.

New Tax Deductions 2026: Tips, Overtime & Seniors

Federal enhancements (permanent TCJA + new provisions) flow to CA via conformity:

- Overtime pay deduction: Up to $12,500 (single)/$25,000 (joint) for qualified overtime, income limits apply (e.g., under ~$150K).

- Tips deduction: Up to $25,000 qualified tip income.

- Seniors deduction: Extra $6,000 (single)/$12,000 (joint if both 65+) on top of standard.

- Other: Temporary car loan interest deduction, enhanced child tax credit.

- Gambling losses: Now up to 90% of winnings.

- Alimony: CA conforms to TCJA (non-deductible/non-taxable post-2018 divorces, with 2025+ updates requiring month/year reporting on Schedule CA).

These can boost refunds for service workers, overtime earners, and seniors. CA SDI withholding rate at 1.3% (no cap).

Claiming CalEITC 2026: California Cash Back Credits

California Earned Income Tax Credit (CalEITC) offers up to $3,756 refundable cash back for low-income workers (2025 tax year). Eligibility:

- Earned income: At least $1, up to ~$32,900 (varies by family size).

- Age: 18+ or qualifying child.

- Valid SSN/ITIN (employment-eligible).

- Investment income limits.

Max credits (approximate for 2025):

- No kids: ~$302.

- 1 child: ~$2,016.

- 2 children: ~$3,339.

- 3+ children: ~$3,529+.

Related: Young Child Tax Credit (YCTC) up to $1,189 (kids under 6); Foster Youth Tax Credit (FYTC) similar. Claim via Form FTB 3514 with return. Use FTB EITC calculator for estimates. It supports families statewide, often pairing with federal EITC.

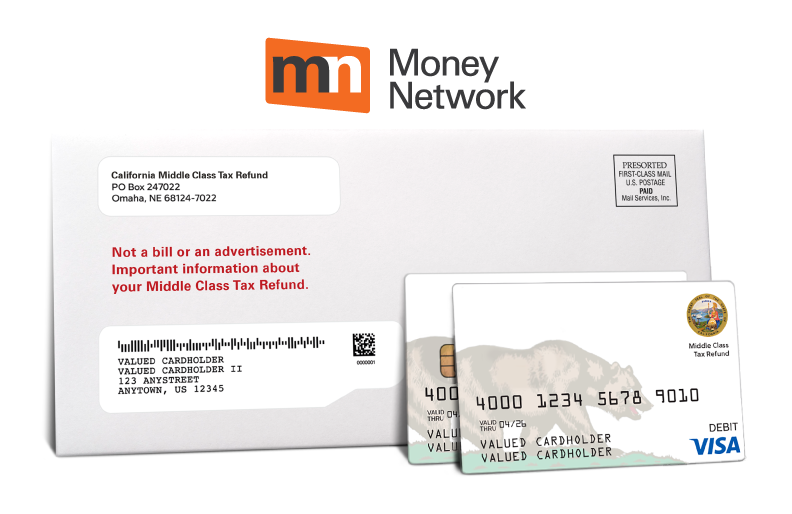

2026 California Tax Refund: New Credits & Rules

Refunds may be larger due to higher SALT cap, new deductions, permanent lower federal brackets, and enhanced CalEITC. Standard deduction increased (federal ~$16,100 single/$32,200 joint for 2026). No major new state hikes; focus on credits and conformity. Potential future changes (e.g., billionaire tax ballot measure) not yet in effect.

How to Track Your California State Tax Refund 2026 / California FTB Refund Status

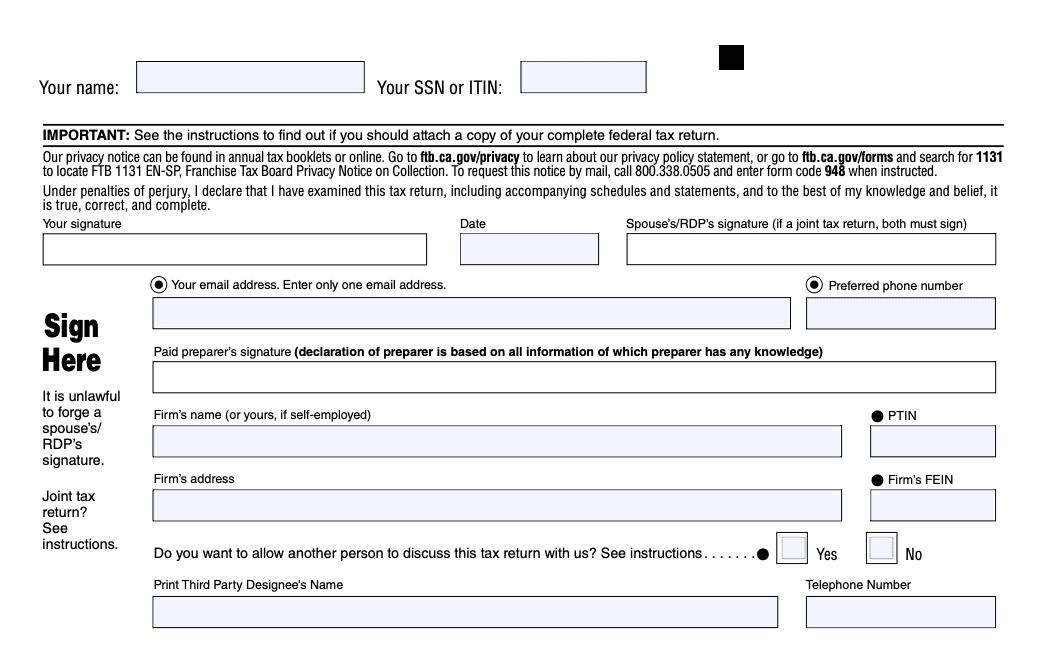

Use FTB's Where's My Refund? tool at ftb.ca.gov/refund:

- Need: SSN/ITIN, filing status, exact refund amount.

- Processing: e-file refunds often 1-3 weeks; paper 3-4 months+.

- Business refunds longer.

- If amount differs: Wait for mailed letter.

Call 800-852-5711 if needed. Avoid scams—FTB doesn't request info via text/email. Create MyFTB account for updates.

IRS vs. FTB: 2026 California Tax Changes Explained

Federal: Permanent TCJA rates/brackets, $40K SALT (phased), new overtime/tips/seniors deductions, inflation adjustments.

California: High state rates, CalEITC (more generous), partial conformity (e.g., alimony reporting updates via SB 711). FTB emphasizes scam awareness, free filing (CalFile opens Jan 20, 2026 for qualifiers), disaster relief, and e-filing.

File early electronically for faster refunds/credits. Use official calculators. Consult a pro for complex situations—tax laws vary!

Comments

Post a Comment