The 2026 tax filing season is in full swing for the 2025 tax year. The IRS began accepting returns on January 26, 2026, with the deadline set for April 15, 2026. Millions of taxpayers are tracking refunds, especially with the shift toward electronic payments. Here's an updated, comprehensive guide with key visuals to help you understand the process.

IRS Tax Filing Season 2026

The IRS tax filing season 2026 officially kicked off on January 26, 2026. Expect around 164 million individual returns this year. Early filers are already seeing status updates.

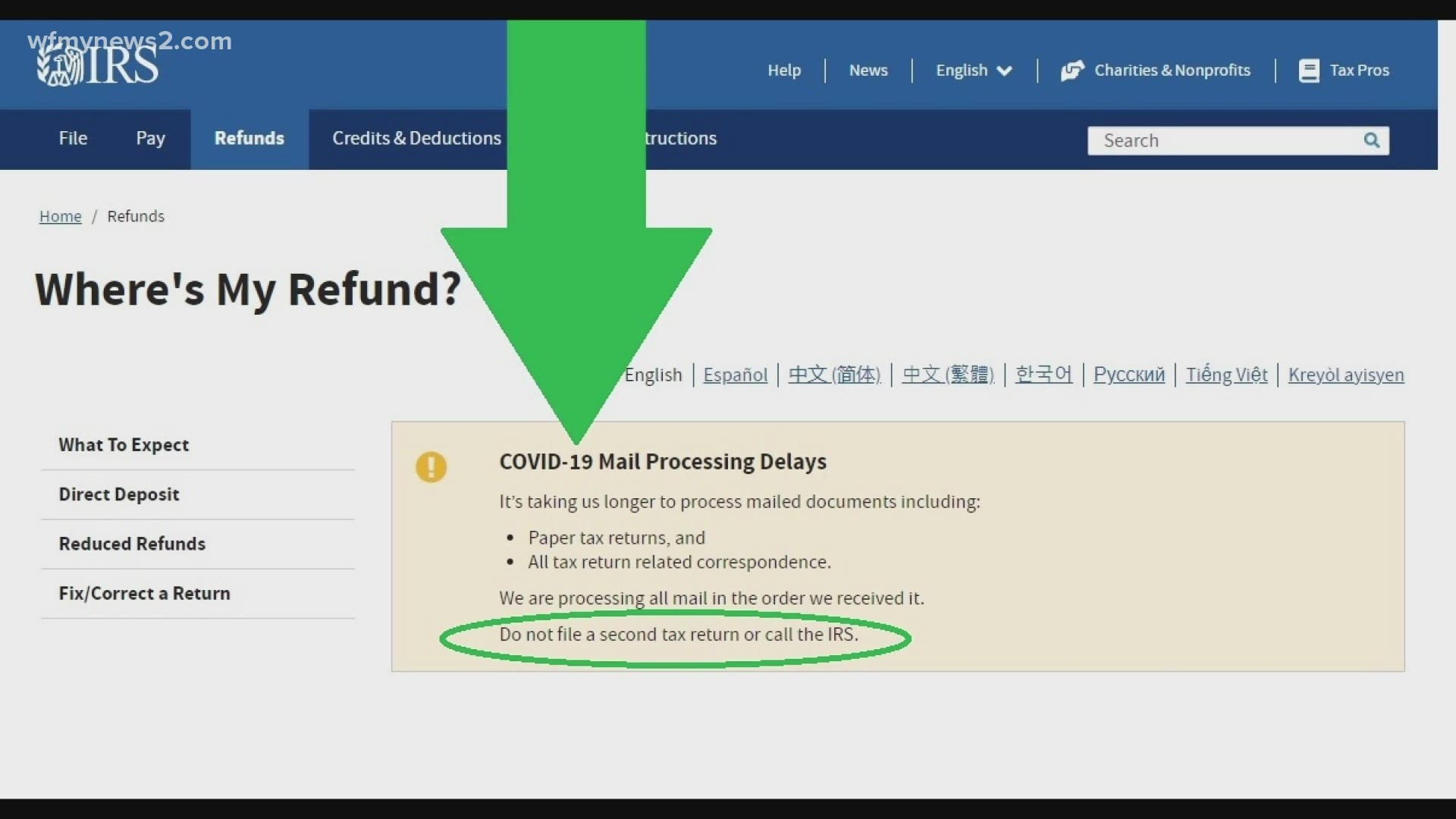

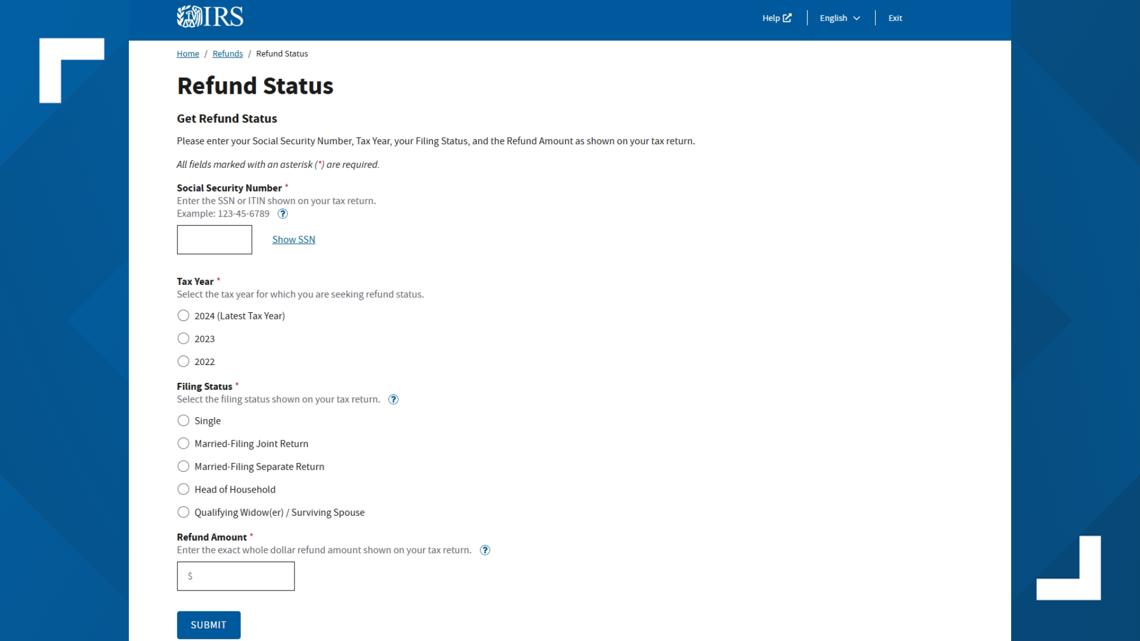

Where's My Refund 2026

The best tool for checking your IRS refund status is Where's My Refund? on IRS.gov or the IRS2Go app. Enter your SSN/ITIN, filing status, and expected refund amount. Updates happen daily (overnight), often showing status within 24 hours of e-filing.

2026 Tax Refund Schedule

For e-filed returns with direct deposit, most refunds arrive within 21 days of acceptance. Here's a typical timeline:

- Accepted by late January → Funds by early February

- Mid-February acceptance → Late February/early March

Paper methods are minimized due to the phase-out.

.png)

Tax Refund Direct Deposit Date

Direct deposit is now the standard—faster, secure, and mandated under recent executive orders phasing out paper checks (with limited exceptions). Select it when filing to get funds in days after approval.

IRS Paper Check Phase Out 2026

Paper refund checks are largely eliminated for 2026. If no banking info is provided, the IRS may request it or issue alternatives after delays. Direct deposit avoids holds.

How Long Does a Tax Refund Take 2026

How long does a tax refund take 2026? Error-free e-filed returns with direct deposit: usually under 21 days. Complex returns (e.g., EITC claims) or reviews can add time. Track via Where's My Refund? for real-time updates.

Fastest Way to Get Tax Refund

E-file early, choose direct deposit, double-check for errors, and avoid paper filing. This combo delivers the quickest results.

For personalized status, head to IRS.gov/refunds or use the app. If delays occur (e.g., due to reviews or external factors like any ongoing operational notes), the tool will show details. File accurately and check often—most get good news fast this season!

Comments

Post a Comment