|

| Nikkei hits record high as LDP victory lifts growth outlook |

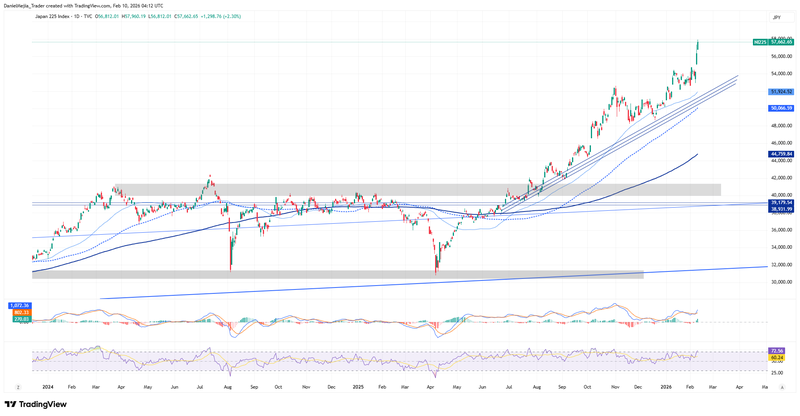

– The Japanese stock market has surged to unprecedented heights, with the Nikkei 225 index breaching the 58,000 mark for the first time in its history on Thursday. This historic milestone, which saw the benchmark index touch an intraday record of 58,015.08 before closing slightly lower at 57,639.84, is largely attributed to renewed investor confidence following Prime Minister Sanae Takaichi's decisive victory in the recent Lower House snap election. The broader Topix index also advanced, gaining 0.7% to close at 3,882.16.

Market analysts are coining this phenomenon the "Takaichi Trade," a testament to the significant impact of the Prime Minister's economic agenda. Takaichi's landslide win has provided her with a robust mandate to implement her conservative policy platform, which is widely perceived as pro-growth and supportive of both the Japanese markets and its corporate sector . This renewed political stability and clear economic direction have fueled a bullish sentiment among investors, leading to a rare triple rally encompassing stocks, government bonds (JGBs), and the yen.

The Pillars of 'Takaichinomics'

Prime Minister Takaichi's economic strategy, dubbed "Takaichinomics," is built upon several key pillars aimed at revitalizing the Japanese economy:

Takaichi's economic strategy is characterized by a "responsible yet proactive" fiscal policy, emphasizing expansionary measures to stimulate growth through increased government spending and investment. Concurrently, the administration is expected to maintain supportive monetary conditions, aligning with the goal of achieving sustainable real wage growth and bolstering market liquidity through accommodative policies from the Bank of Japan. A notable proposal from Takaichi's platform is a "food tax pause," designed to alleviate cost-of-living pressures and potentially stimulate consumer spending. Beyond these immediate measures, Takaichinomics aims to address long-standing economic challenges, including lifting real wages, overcoming low productivity, and navigating inflationary hurdles. The Prime Minister's substantial parliamentary majority, a two-thirds "supermajority" in the Lower House, provides her with significant legislative power to implement fiscal programs across critical sectors such as technology, defense, and energy.

The Japanese market's rally occurred amidst a mixed global economic backdrop. Stronger-than-expected U.S. payroll data (130,000 new jobs versus an anticipated 55,000) dampened expectations for Federal Reserve rate cuts, causing a slight dip in U.S. markets. However, Asian markets, including Japan's Nikkei and South Korea's Kospi, largely shrugged off these concerns. The Kospi index, for instance, also hit a record high, jumping over 3%, indicating a broader regional surge in investor confidence .

Investor sentiment regarding Japan has shifted dramatically, with many now proclaiming that "Japan is back." This narrative is gaining significant traction among foreign institutional investors, who are increasingly bullish on the prospects of the Japanese economy under Takaichi's leadership . While the rally is robust, analysts note potential intervention risks if the yen approaches 160 against the U.S. dollar, a level that could trigger concerns about currency stability.

Geopolitical factors also play a role. While former U.S. President Trump's support for Takaichi has been noted, tensions persist over investment delays. Furthermore, Takaichi's conservative agenda and firm stance on economic coercion are significant considerations in Japan's relations with China.

The historic breach of the 58,000 mark by the Nikkei 225 signals a new era of optimism for the Japanese economy. The "Takaichi Trade," driven by a clear political mandate and a comprehensive economic agenda, has successfully reignited investor interest. As the market navigates potential currency fluctuations and evolving geopolitical dynamics, the world will be watching to see if Takaichinomics can sustain this momentum and deliver on its promise of long-term growth and prosperity.

Comments

Post a Comment