US Inflation Hits Near Five-Year Low in January 2026 as Gas Prices Plunge and Housing Costs Finally Cool

US inflation cooled to a near five-year low in January 2026, as sharply lower gasoline prices and a noticeable slowdown in housing costs finally gave American consumers some breathing room after years of relentless price pressure.

The Consumer Price Index rose just 2.4% year-over-year in January—down from 2.7% in December and the softest reading since mid-2021—coming in below Wall Street's consensus forecast of 2.5%. Stripping out the volatile food and energy categories, core CPI climbed 2.5% annually, its slowest pace since early 2021, while the month-to-month increase held at a tame 0.3%.

What drove the drop? Energy and vehicles led the way. Gasoline prices plunged 7.5% from a year earlier, with a steep 3.2% monthly decline in January alone in many regions. Used-vehicle prices fell roughly 2%, and grocery inflation remained modest at +0.2% month-over-month. Shelter costs—the single biggest component of CPI—continued to decelerate, now growing around 3% annually, a far cry from the double-digit spikes seen in 2022–2023.

Caption: Gas prices trending lower at pumps across the U.S. in early 2026—sharp declines in gasoline helped pull headline inflation down to 2.4%, offering relief at the pump for drivers nationwide.

The Federal Reserve will view this as vindication of its patient approach. With inflation edging closer to the 2% target, markets are pricing in a greater likelihood of rate cuts later this year, which could ease borrowing costs on everything from mortgages to auto loans. The 10-year Treasury yield dipped immediately following the release, reflecting that optimism.

One under-discussed dynamic: Despite the tariffs rolled out in 2025, a number of businesses appear to have absorbed portions of those added costs rather than immediately passing them through to shoppers. This muted pass-through has helped keep near-term inflation pressures contained, though economists caution that some delayed effects could emerge in the spring and summer. Meanwhile, moderating wage growth—tied to slower hiring—has further eased businesses' need to raise prices to cover labor expenses, supporting the case for a classic "soft landing."

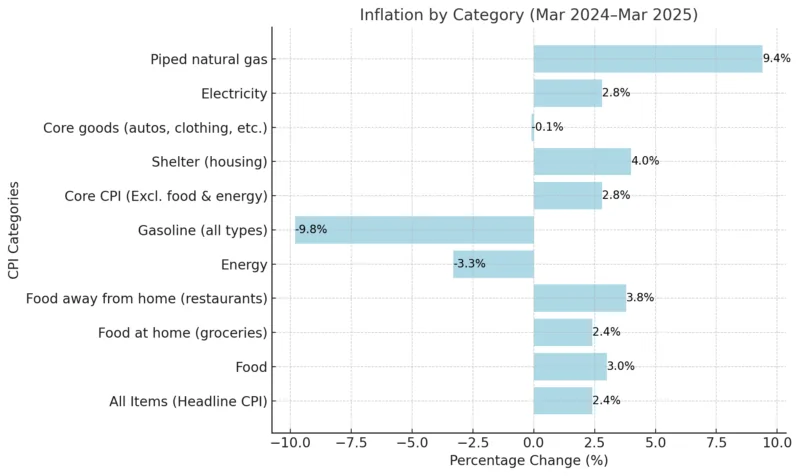

Caption: Inflation breakdown by category (recent trends extending into 2026)—energy and core goods showing outright declines or minimal increases, while shelter remains the stickiest component but continues to cool.

Housing affordability shows early signs of improvement The post-pandemic rent explosion, which often exceeded 15% annual growth in hot markets, has clearly lost steam. With more multifamily construction coming online—especially in the South and West—supply is finally catching up in many areas. Shelter inflation's slowdown is one of the most encouraging developments for household budgets, and if mortgage rates follow Treasury yields lower, homebuying could become marginally more accessible by mid-year.

Caption: Modern apartment complexes rising in U.S. cities—Increased multifamily supply in key regions is helping temper rent growth and ease long-standing affordability pressures in the housing market.

If viewed as a whole Prices overall remain 20–25% higher than in early 2021, so this isn't a return to pre-pandemic normalcy. But January's report marks tangible progress: lower fuel bills, steadier rents, and the prospect of cheaper credit are starting to translate into real improvements in day-to-day affordability for millions of households.

Still, vigilance is warranted. Tariff-related cost pressures, geopolitical energy risks, and any unexpected wage rebound could alter the trajectory. For now, though, the data points to inflation continuing its downward glide path through 2026—provided no major shocks intervene.

(This analysis draws on the latest BLS release, cross-referenced market reactions, regional housing-supply trends, and tariff pass-through dynamics observed so far in 2026.)

Comments

Post a Comment